If you want to wrap your head around the stock market, nothing beats getting into some tried and true books that break things down in a way that actually makes sense. There are a ton of resources out there, but some books really do a solid job of explaining the nuts and bolts, from basic concepts all the way to the more advanced stuff. I’m going to go over some of my personal favorites, the kinds of books that can help you understand how the stock market ticks, whether you’re totally new or been at it for a while but want to get a better grip.

Why Understanding the Stock Market Matters

The stock market isn’t just for Wall Street pros or big time traders. Regular people use it to build savings, plan for retirement, and grow their money over time. When you really understand how the market works, you’re way better equipped to make decisions, avoid common mistakes, and handle the ups and downs that make most new investors feel anxious. Getting some solid background knowledge through books is pretty handy because you can learn at your own pace and go back to important sections whenever you need a refresher.

Books give you context, like why certain market patterns happen or what drives stock prices. They also explain investing strategies, common mistakes, and the psychology behind why people buy or sell. You’ll find that having a good foundation pays off, especially when markets get wild and the headlines are full of doom and gloom. In fact, many experienced investors often recommend rereading the classics whenever you feel uncertain. Just spending time with a well-written book can give your confidence a boost during those tricky moments.

My Top Book Recommendations for Understanding the Stock Market

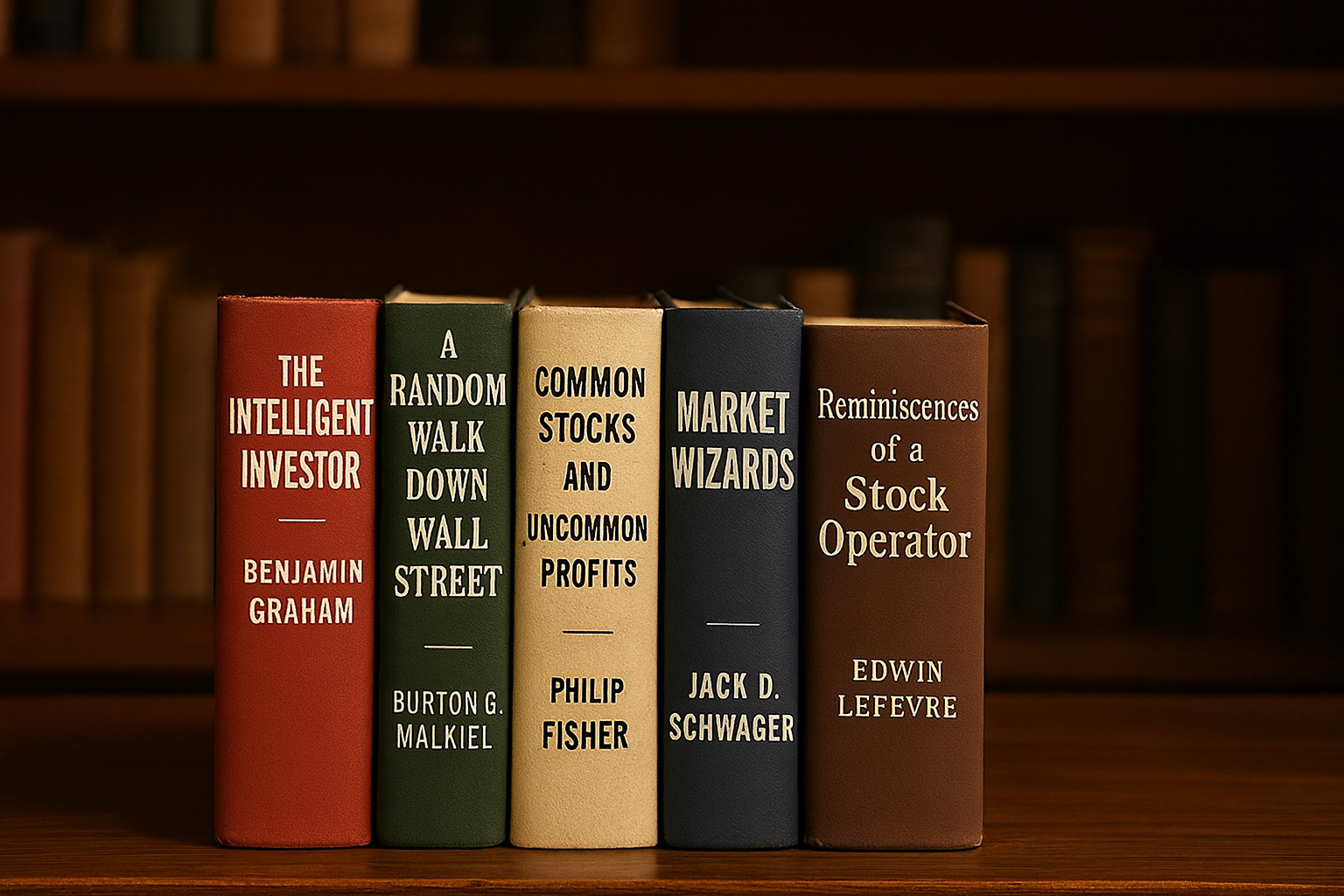

The right book depends a bit on your style and experience, but these picks cover a good stretch of what you need to know. I’m sharing the books that I (and many others) feel really deliver practical advice and explanations that stick.

- The Intelligent Investor by Benjamin Graham: This classic is often described as the bible of value investing. Graham’s ideas about investing with a margin of safety, staying patient, and analyzing stocks beyond the hype are still super relevant. I found the newer editions with commentary by Jason Zweig very readable. Many beginners (and even seasoned investors) revisit this one over and over.

- A Random Walk Down Wall Street by Burton G. Malkiel: If you’ve ever wondered whether it’s possible to “beat the market,” this book tackles that question head on. It explains why index funds can be a solid bet for most people and breaks down lots of fancy terms you hear thrown around.

- Common Stocks and Uncommon Profits by Philip Fisher: Fisher’s approach focuses on what makes a company tick, like management quality and growth potential. His “15 points to look for in a stock” checklist is one I still refer to.

- One Up On Wall Street by Peter Lynch: Lynch shares how regular folks who pay attention to everyday products and companies can spot great investing opportunities. The writing style is friendly and full of practical examples.

- The Little Book of Common Sense Investing by John C. Bogle: Bogle, the founder of Vanguard, lays out why low cost index funds are a smart choice, especially for people who don’t want to spend every day watching the markets.

For folks wanting a deeper look into technical analysis (studying charts and price movements), Technical Analysis of the Financial Markets by John J. Murphy is often recommended. If you want a broader history of how markets grow and change, check out Stocks for the Long Run by Jeremy Siegel, which explains how stocks have performed over the last century. Meanwhile, if you prefer learning through stories, something like “Reminiscences of a Stock Operator” by Edwin Lefèvre offers engaging tales based on real market lore, bringing out the human side of trading.

Key Concepts Covered in These Books

Most top stock market books share certain big ideas that anyone studying the market should know about. Here are a few concepts you’ll run into a lot, and they’re worth understanding from the start:

- Compounding: This is the idea that your investment returns earn returns of their own, and it’s a huge reason why starting early makes a difference.

- Market Psychology: Books like “The Intelligent Investor” talk about how fear and greed can drive markets to weird extremes. Learning to recognize these emotions can help you avoid making bad decisions during market swings.

- Diversification: Spreading your investments across different stocks and sectors reduces risk. Good books show you how and why diversification works.

- Long Term Investing: Many successful investors stress the importance of sticking with your plan and not getting scared out of good investments during short term market drops.

- Risk Tolerance: Several of the books go into depth about understanding how much risk you’re comfortable with. Learning this can help you build a portfolio that matches your own needs and keeps you from panicking at the worst times.

Understanding these concepts before you start investing is super important. It helps you tune out the noise and focus on what actually grows your money over time.

Learning on Your Own: How to Teach Yourself About the Stock Market

Getting comfortable with the market doesn’t require a finance degree. Books are a great starting point, but you’ll also want to add other resources to fill in gaps and see how things work in real time. Here are some tips that have helped me and others learn independently:

- Start with Books, but Use Free Online Materials Too: After you read through one or two beginner books, websites like Investopedia and the SEC’s investor resources answer lots of common questions and keep things updated. Don’t be afraid to Google terms you don’t understand.

- Follow Actual Market News: Try reading the business section of a trusted newspaper or subscribing to financial podcasts. This helps you get a sense of how theory plays out in the real world.

- Practice Without Risking Cash: Online platforms like Investopedia’s stock simulator let you practice trading with fake money, so you can apply what you learn with zero pressure.

- Join Forums or Communities: Places like the Bogle heads forum or r/investing on Reddit are good for getting different perspectives and asking questions.

- Take Notes and Track Progress: Keep a journal of what you read, questions you have, and observations from simulations or news stories. Over time, you’ll spot trends in your knowledge and understand how your thinking grows.

Consistency makes the biggest difference. Even spending 15-30 minutes a day reading or following the markets helps you build confidence. Technology now makes it even easier: with apps and mobile websites, you can check on your investments, make trades, and read articles on the go, letting you learn wherever you are.

Things to Watch Out for and Common Beginner Struggles

No book is a magic shortcut. It’s pretty normal to feel overwhelmed by all the jargon or start second guessing yourself after a few market dips. Some things I wish I’d known at the start:

- Don’t Chase the Hottest Tip: New investors can be tempted by what’s trending. Most of the books above explain why sticking to a plan works better than bouncing between “hot” picks.

- Be Wary of Get Rich Quick Schemes: Any book that guarantees huge returns with little risk is best avoided. Real investing is about patience and discipline.

- Keep Emotions in Check: The best investors learn to separate emotion from decision making. If you make a mistake, use it as a learning experience, not a reason to give up.

- Understand Risk vs. Reward: Good books will explain how to measure risk, why it matters, and how it lines up with potential rewards. Understanding this prevents you from getting into situations beyond your comfort level.

- Don’t Ignore Fees: Investment costs, like management fees or commissions, can eat into your returns over time. Several books clearly lay out how low cost options give your investments a boost in the long run.

Taking your time to learn and build a foundation makes you much less likely to get tripped up by common pitfalls. Remember that it’s perfectly fine to make small mistakes as you learn. Every misstep is a chance to grow.

Frequently Asked Questions

Here are answers to popular questions that tend to pop up for beginners doing their own research:

What is the best book to understand the stock market?

Answer: For an all purpose introduction, “The Intelligent Investor” by Benjamin Graham is hard to beat. It covers mindset, risk, and practical strategies that hold up decades after its first edition.

How can I teach myself the stock market?

Answer: Start with beginner friendly books, add online learning (videos and articles), use simulators to practice, and stay active in online communities. Keeping a journal of what you learn and any trades you try can help you spot improvements over time.

Which book is best for learning stock?

Answer: If you want clear explanations without too much jargon, “The Little Book of Common Sense Investing” by John C. Bogle is a favorite among beginners. For stories and practical advice, “One Up On Wall Street” by Peter Lynch is another easy to read option.

How to get a better understanding of the stock market?

Answer: Combine reading top rated books and practicing trading in a risk free way (like through stock simulators). Checking out financial news regularly and talking with other investors can also add to your learning and help you see patterns over time.

Bringing It All Together

Understanding the stock market is less about memorizing complicated formulas and more about learning the basics, seeing how the ideas connect, and practicing until it feels natural. Books are an affordable, proven way to kick off your learning or deepen what you already know. As you dig into these recommendations, focus on building good habits and remembering that everyone started as a beginner once. The payoff comes not just from buying and selling, but from knowing why you’re making those moves in the first place.

Whatever your motivation for getting into stocks, a good book and some curiosity can go a long way. Happy reading, and here’s to smarter, more confident investing!